All Categories

Featured

Table of Contents

The are whole life insurance coverage and universal life insurance policy. The money worth is not added to the fatality advantage.

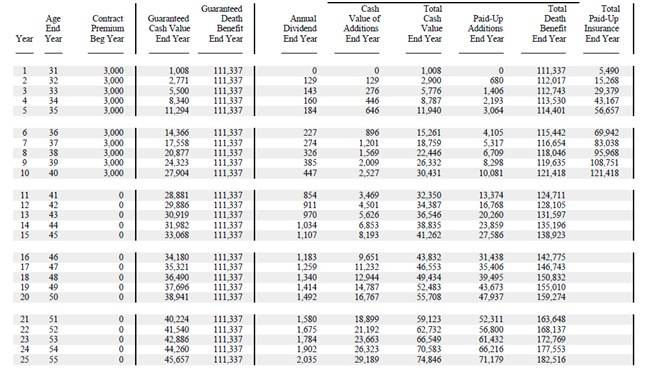

After 10 years, the cash worth has grown to approximately $150,000. He takes out a tax-free finance of $50,000 to start a business with his sibling. The plan lending rates of interest is 6%. He pays off the car loan over the next 5 years. Going this path, the interest he pays returns right into his policy's money worth as opposed to an economic institution.

Visualize never ever having to bother with small business loan or high interest prices again. What happens if you could obtain money on your terms and construct wide range all at once? That's the power of boundless banking life insurance. By leveraging the money worth of entire life insurance policy IUL plans, you can grow your wealth and obtain cash without counting on conventional financial institutions.

There's no set funding term, and you have the liberty to pick the repayment schedule, which can be as leisurely as paying off the car loan at the time of death. This adaptability reaches the maintenance of the lendings, where you can decide for interest-only repayments, maintaining the loan equilibrium level and workable.

Holding cash in an IUL taken care of account being attributed rate of interest can typically be much better than holding the cash money on deposit at a bank.: You've constantly imagined opening your very own bakery. You can obtain from your IUL plan to cover the initial expenditures of renting a space, acquiring devices, and employing team.

Infinite Family Banking

Personal lendings can be acquired from traditional financial institutions and credit history unions. Obtaining money on a credit rating card is normally extremely costly with yearly percent prices of interest (APR) frequently reaching 20% to 30% or even more a year.

The tax obligation therapy of plan loans can differ significantly relying on your country of house and the certain regards to your IUL plan. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy car loans are typically tax-free, using a considerable advantage. In other territories, there might be tax implications to consider, such as prospective taxes on the loan.

Term life insurance policy just gives a fatality benefit, without any kind of cash money worth buildup. This means there's no cash worth to obtain against.

Infinite Banking Reviews

When you initially hear concerning the Infinite Banking Principle (IBC), your initial response might be: This sounds also great to be true. The problem with the Infinite Financial Concept is not the principle however those individuals offering an unfavorable critique of Infinite Financial as a principle.

So as IBC Authorized Practitioners via the Nelson Nash Institute, we believed we would answer several of the leading inquiries individuals look for online when discovering and comprehending whatever to do with the Infinite Banking Idea. What is Infinite Financial? Infinite Financial was created by Nelson Nash in 2000 and fully clarified with the publication of his book Becoming Your Own Banker: Open the Infinite Banking Principle.

Infinite Banking Uk

You believe you are appearing monetarily ahead because you pay no passion, yet you are not. When you save money for something, it typically indicates giving up something else and reducing back on your way of living in other areas. You can repeat this process, however you are merely "reducing your method to wealth." Are you pleased living with such a reductionist or shortage way of thinking? With conserving and paying cash money, you might not pay rate of interest, yet you are utilizing your money as soon as; when you spend it, it's gone forever, and you quit on the opportunity to make lifetime substance rate of interest on that cash.

Also banks use entire life insurance policy for the exact same purposes. The Canada Earnings Firm (CRA) even recognizes the value of getting involved entire life insurance policy as an one-of-a-kind property class used to produce long-term equity safely and naturally and provide tax obligation benefits outside the scope of typical investments.

Is Infinite Banking A Scam

It allows you to create wealth by fulfilling the financial function in your own life and the capacity to self-finance significant way of life acquisitions and costs without disrupting the compound passion. One of the easiest ways to think regarding an IBC-type taking part whole life insurance policy policy is it is comparable to paying a home mortgage on a home.

When you obtain from your participating entire life insurance plan, the cash value continues to expand continuous as if you never borrowed from it in the very first location. This is due to the fact that you are making use of the money value and fatality advantage as collateral for a funding from the life insurance business or as security from a third-party lending institution (known as collateral financing).

That's why it's vital to collaborate with a Licensed Life insurance policy Broker authorized in Infinite Banking who structures your taking part whole life insurance policy correctly so you can avoid negative tax obligation implications. Infinite Financial as a financial strategy is except everyone. Below are some of the advantages and disadvantages of Infinite Banking you must seriously think about in determining whether to relocate onward.

Our recommended insurance coverage provider, Equitable Life of Canada, a mutual life insurance policy business, specializes in getting involved entire life insurance policies specific to Infinite Banking. In a mutual life insurance business, policyholders are considered firm co-owners and receive a share of the divisible excess generated each year through dividends. We have a range of service providers to select from, such as Canada Life, Manulife and Sunlight Lifedepending on the requirements of our customers.

Please also download our 5 Top Questions to Ask An Infinite Banking Representative Prior To You Employ Them. To learn more regarding Infinite Financial browse through: Please note: The product given in this newsletter is for educational and/or educational purposes just. The info, viewpoints and/or views expressed in this newsletter are those of the authors and not always those of the supplier.

What Is A Cash Flow Banking System

The idea of Infinite Financial was developed by Nelson Nash in the 1980s. Nash was a finance expert and follower of the Austrian institution of business economics, which advocates that the worth of items aren't explicitly the outcome of traditional economic structures like supply and need. Instead, individuals value money and items in different ways based on their economic standing and demands.

Among the risks of typical banking, according to Nash, was high-interest prices on car loans. Too lots of people, himself included, obtained into economic trouble because of dependence on banking establishments. As long as banks set the rate of interest and loan terms, individuals didn't have control over their very own wide range. Becoming your very own banker, Nash established, would place you in control over your monetary future.

Infinite Financial needs you to possess your monetary future. For goal-oriented individuals, it can be the best monetary tool ever before. Here are the benefits of Infinite Banking: Perhaps the single most valuable facet of Infinite Financial is that it boosts your cash money circulation.

Dividend-paying entire life insurance policy is very reduced danger and uses you, the insurance policy holder, a good deal of control. The control that Infinite Financial offers can best be organized right into two classifications: tax obligation benefits and asset protections. One of the reasons entire life insurance coverage is ideal for Infinite Financial is exactly how it's taxed.

Entire life insurance coverage policies are non-correlated possessions. This is why they work so well as the financial structure of Infinite Financial. No matter what happens in the marketplace (stock, realty, or otherwise), your insurance plan retains its well worth. A lot of people are missing this essential volatility buffer that assists protect and expand wide range, rather dividing their cash right into 2 containers: bank accounts and financial investments.

Whole life insurance is that third pail. Not only is the price of return on your whole life insurance coverage policy guaranteed, your fatality advantage and costs are likewise assured.

Infinite Banking Calculator

Infinite Financial appeals to those looking for greater economic control. Tax obligation efficiency: The cash worth grows tax-deferred, and policy financings are tax-free, making it a tax-efficient device for developing wide range.

Possession security: In many states, the cash money value of life insurance policy is secured from financial institutions, including an added layer of monetary protection. While Infinite Banking has its advantages, it isn't a one-size-fits-all remedy, and it comes with significant downsides. Here's why it may not be the very best technique: Infinite Banking commonly calls for intricate plan structuring, which can perplex insurance holders.

Latest Posts

How Can I Be My Own Bank

Life Insurance Banking

Bank On Yourself Reviews